Understanding Tax in Retirement

Navigating the complexities of taxation in retirement is crucial for maximizing your financial well-being. In this blog, we outline what you need to know about navigating tax in retirement – from the options available to you to strategies to minimise tax.

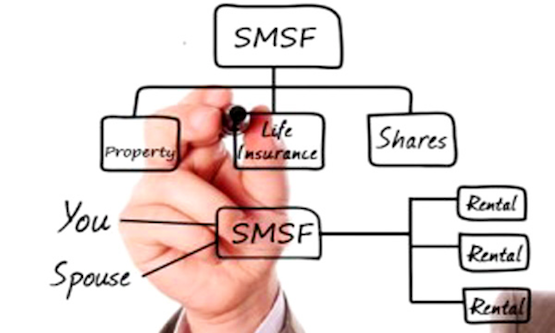

How to Maximise & Protect Your SMSF

Are you looking to maximise and protect your SMSF assets for the long-term?

Read our latest blog and see what our specialists have to say about the importance of having a well-diversified portfolio, a clear investment strategy, adequate insurance coverage, a robust estate plan, and a clear succession plan when it comes to maximising and protecting your SMSF.

Understanding The Basics Of Tax On Superannuation

Understanding tax on super can be complicated, but Agilis CA can help with minimising your tax and making the most of super with some simple strategies. Talk to us today about getting your super sorted.

How Will You Decide on Your Financial Planner?

Decision making can be hard. As humans, we often suffer from mental biases that hinder our ability to make ideal choices. Or we simply leave things in the ‘too hard basket ’knowing we will get around to sorting it out one day. As a financial adviser, I often find myself helping clients navigate this process, […]

How Much Super Do I Need to Retire?

Superannuation, also known as Super, is a fixed amount of money that employers are legally bound to keep aside on behalf of their employees. The employees themselves can add onto this by depositing money in their Super account. This money is kept safe until retirement after which the employee can utilise the money. This form […]

Why Is It Important To Pay Your Super On Time?

What is a Super? Superannuation, also known as ‘super’, is the amount of money set aside and saved by employees so that they can use it later in the long run, after their retirement. It is like a savings account where the more you deposit, the greater the outcome will be. It is the money […]

Is an SMSF right for you?

There is no one correct answer as to whether a self-managed superannuation fund (SMSF) is the right structure for your retirement savings – to a certain extent it does come down to personal choice. There are, however, certain broad issues that you should consider before setting up a SMSF. In 2012, the Australian Securities and […]

The biggest changes to super in a decade – how to capitalise now!

Major changes to tax and superannuation have just been approved by the Government in early December 2016. These are the biggest changes in the last 10 years. They are significant. Most of these changes will take place on 1 July 2017. That’s why we need to start planning ASAP with you. The expert Agilis Team have spent […]

Tax Planning for the future

Let tax planning be more than just getting a bigger refund It’s the first quarter of the new financial year. It’s the best time to sit down and start to map out your financial year goals and ensure you’re headed on the right track. While we all love spending money on what we need now, tax […]