In the last blog in this series, we looked at the difference you can make to the cost of your mortgage by ensuring that you’re not paying over the odds on rate, as well as some of the complexities around rate that need to be considered when refinancing.

Here I’m looking at how you can set up some healthy financial habits that will not only reduce finance related stress and smooth your cash flow, but also save you thousands on interest and years off your mortgage.

Each time you look at your mortgage, this involves looking at your family budget. While this doesn’t usually top the list of the way we like to spend our time, there is an upside to the exercise if we can leverage it to your advantage . It often presents an opportunity to better manage cash flows and through this it can make a huge difference to your bottom line, especially if the changes can be automated.

There are a few categories of savings that make sense for everyone to have:

- Emergency savings – depending on your age and commitments a good target is somewhere between 3 and 6 months net income. How much you need in this category to feel secure will also depend on your personal risk profile and how easily you might be able to replace your income through finding a new role in the event of retrenchment etc. These should be funds that you don’t dip into for anything else.

- Cash flow savings – these are funds set aside from each pay check to cover expenses that you know are coming, but are paid less frequently than your pay cycle. These could include quarterly bills like rates, body corporate fees, electricity etc. There are simple ways to work out how much you should be setting aside that don’t involve a weekend of wading through bills.

- Home loan repayment savings – by calculating what your home loan repayment would be if rates went up by even just 1% and setting the difference aside, you’ll not only have a buffer in place if rates do rise but you’ll also have the benefit of extra savings on your mortgage that increase at a compounding rate each month.

- Fun – Savings for holidays or family adventures and activities that cost more than you can cover in any given month. Some of these savings may go towards extra expenses at Christmas etc, these could also be savings towards that trip of a lifetime.

A real life example:

It’s often easier to see how powerful these strategies can be by looking at a real life example. Let’s take a young family with two kids on a reasonably tight budget. After tax, their total family income is $80 000 a year.

Their goal is to have emergency savings of 3 months net income, or $20 000. As they have recently bought their first home and then had their second child, their savings aren’t substantial. They’ve set a target to work towards having their emergency savings in place over 3 years, so they’re saving $ 500 per month towards this.

Their living expenses each month are around $4000 per month, excluding their mortgage. Of this around $1250 are bills like electricity, rates, school fees, rego and insurance that are paid quarterly or annually. The balance of $2250 includes general living expenses and a monthly fun budget.

They are setting aside $400 per month towards family holidays and extra expenses over Christmas time and birthdays.

Their home loan is the same one we calculated savings on in the previous blog — $ 400 000 where we reduced the rate from 4.25% to 3.95%. They kept their repayments the same even though their rate dropped, so they’re already part of the way there on the changes they need to make to ramp up their home loan repayment savings.

Their home loan repayment savings are set at repayments at 4.95% less their actual minimum repayment at 3.95%. On their $400 000 mortgage, this equates to $ 236 per month in addition to their mortgage repayment of $1900pm.

To see how this works for them, let’s look at where they are at the end of the first year, and then at the end of year 3.

At the end of 12 months, their savings balances are :

Emergency savings $ 6000

Cash flow savings $ 3125 (approx. 2.5 months of monthly amount saved as expenses are paid from these savings)

Fun savings $ 1600 (assuming around 2/3 of the fun savings used and the rest saved towards longer term adventures)

Home loan savings $ 2832

Total savings $ 13557

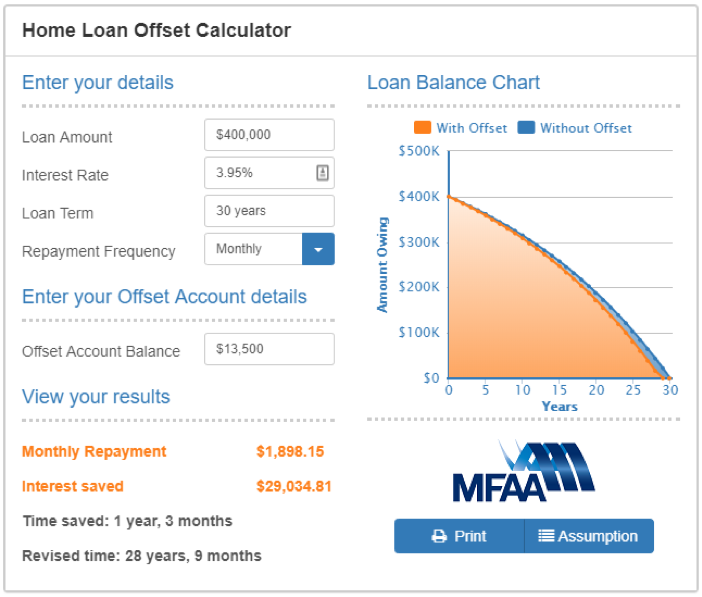

In year 2, they’ll save around $533 in interest (on their $ 13 500 saved) but over the life of the loan, with no further savings, this would be savings of almost $30 000 in interest and a little over a year off their mortgage.

Let’s roll this forward for another 24 months assuming they continue to add to their savings:

Emergency savings $ 18000 ( 36 months at 500 per month)

Cash flow savings $ 3125 (average balance)

Fun savings $ 4800

Home loan savings $ 8496

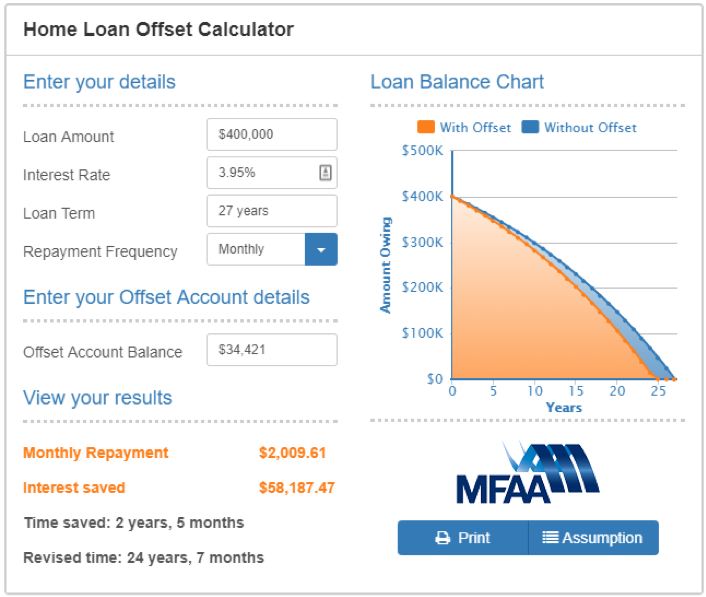

Total savings held $ 34421

At only 3 years in, if they did nothing more (and maintained this level of savings) they would save $ 58187 in interest and 2.5 years off the mortgage over the life of the loan.

Not only have this family achieved their peace of mind goals of having 3 months income set aside for emergencies, they now have a buffer in place to protect them in the event that interest rates rise. On top of that they’re on their way towards their goal of a fabulous family holiday adventure.

At this stage, happy with the level of their emergency savings, they could split the $500 per month and add half to the home loan repayment savings and half to fun savings, ramping up their financial goals and their fun!

By spending a little extra time upfront getting advice on a personally tailored home loan strategy supported by the right structure, and an automated savings plan set up with their loan, they’re achieving all these goals and saving almost $ 60 000 in interest and 2 and a half years off their mortgage.

If you’d like to see how powerful keeping your savings in offset could be on your mortgage, visit my website at www.affinitasfinance.com.au/calculators/

If you’d like to chat about a personalised strategy, get in touch on 0430 383 996 or tanya@affinitasfinance.com.au.