Do you earn more than $250,000 per year? If you do, are you aware of your requirements conferring with Division 293 Tax?

Division 293 is an additional tax on high income earners, but many individuals are not aware of it and whether it applies to them. Agilis CA is here to break down what exactly Division 293 Tax is, who it applies to, how to pay it and how it is calculated.

What is Division 293 Tax?

Division 293 Tax is an additional tax on an individual’s super contribution that is designed to reduce tax concessions for those whose combined income and contributions cross the Division 293 threshold.

In July 2017, the Division 293 Tax threshold was lowered from $300,000 to $250,000.

High income earners have a higher marginal tax rate than the average income earner – therefore, when a concessional contribution to their fund is made, they subsequently receive a larger tax concession.

The purpose of Division 293, is to charge an extra tax of 15% to put the concession back in line with the average rate and reduce the tax benefits high income earners receive from their super – leveling the playing field for those who earn an average income.

Who does Division 293 Apply to?

If you earn more than $250,000/year regarding annual income and super contributions, you will be required to pay an additional 15% tax on either your contributions or the amount that exceeds the Division 293 threshold (depending on which amount is lower).

Division 293 – Income

Division 293 Tax calculations are based on your Division 293 income, with the data collected from your tax return.

When doing this, reportable superannuation charges are disregarded on your tax return, with these contributions counted elsewhere.

Division 293 Income is calculated similarly to Income for Medicare levy surcharge purposes.

The ATO’s income calculation is based on:

-

- Your taxable income

- Reportable Fringe Benefits

- Reportable Super Contributions

- Total net investment loss

- Family trust distribution tax paid amount

Division 293 – Contributions

To determine Division 293 taxable contributions, the information required is reported by your super fund.

Division 293 contributions are your super contributions made before tax.

These include:

-

- Employer contributions e.g.salary sacrifice made to super fund

- Notional tax contributions if you are a part of a defined benefit fund

- Unfunded defined benefit contributions

- Constitutionally protected funds

When distinguishing which contributions are Division 293 contributions, contributions that attract certain additional tax are not considered.

One-Off Circumstances

It is possible for you to cross the Division 293 threshold due to certain happenings increasing your yearly income in a one-off event – such as you make a capital gain or receive an eligible termination payment.

As a result of this income boost, your marginal tax rate for the year increases and so does the concession on your concessional contributions.

Thus, Division 293 Tax still applies even if it is a one-off circumstance.

ATO CASE STUDY

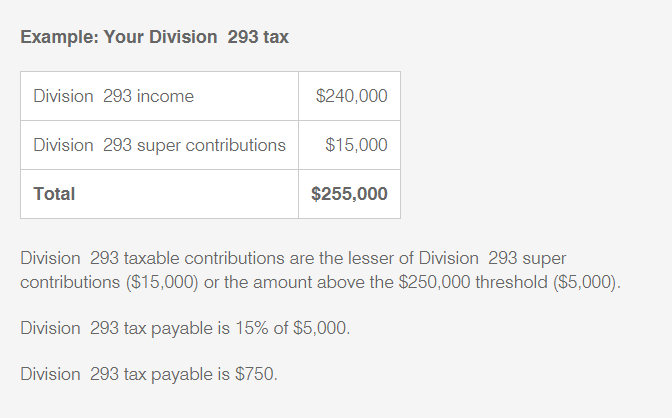

Below is a screenshot of a Division 293 example provided by the ATO. Agilis CA have provided a fake scenario to help you further understand the example.

(Source: Australian Taxation Office, 2021).

Georgia earns an annual salary of $240,000 and her employer contributions are $15,000. Her total income is therefore $255,000 – crossing the Division 293 threshold of $250,000.

A Division 293 taxable contribution is whichever amount is smaller – a Division 293 super contribution or the amount above the $250,000 threshold.

In Georgia’s case, it is the amount above the $250,000 threshold ($5,000).

Her Division 293 tax payable is then 15% of 5,000, which is $750.

I Cross the Division 293 Threshold – What Now?

When your income and contribution information is lodged with the ATO, they will send out a notice of assessment if they see that you cross the Division 293 threshold. This notice will only be sent once the ATO also receives your contribution information from your super fund.

This notice of assessment will be sent to your myGov inbox if your tax return is lodged using myTax, or if your communication preference states that notices should be sent to your registered tax agent – such as Agilis CA – it will be sent to them.

When paying for Division 293 Tax, you can choose to pay for it personally, or have it deducted from your super fund.

Speak to Agilis CA today if you are unsure whether Division 293 Tax applies to you

If you are unsure whether you cross the Division 293 threshold, contact Agilis CA today – we can review your income and contribution information, to determine whether it will apply to you and where to go from there.

If it does apply to you, and you want us to be the ATO’s first point of contact regarding your Division 293 payment, we can also help in arranging this.