Truckies – 6 Tips for Keeping Yourself and Your Business Healthy

Truck Drivers – both long haul or short haul – are an essential part of the lifeblood of any western nation. Whether it be our food, fuel, building materials, furniture, motor vehicles or any other general parcel – they all need to be trucked around our country and within our cities. Trucking is not for […]

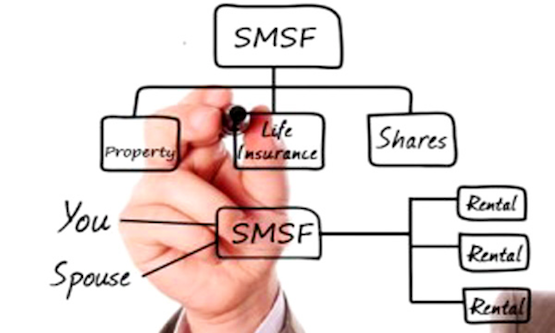

Is an SMSF right for you?

There is no one correct answer as to whether a self-managed superannuation fund (SMSF) is the right structure for your retirement savings – to a certain extent it does come down to personal choice. There are, however, certain broad issues that you should consider before setting up a SMSF. In 2012, the Australian Securities and […]

Collecting bad debts the right way

Most small businesses, at one point or another is likely to have bad debtors. But, let’s be honest, no one likes making those phone calls. Here are three simple steps to ensure your phone call results in a debt paid. Step 1 – Preparing to make the call Before calling make sure you have all […]

Christmas Tips For Small Business

While Santa is double checking his naughty and nice lists, small business owners should make and review their own list of tasks to ensure the festive season shut-down and return to work is a jolly time for all concerned. Get into the festive spirit December is a busy time of year for most businesses trying […]

Should I have a Family Trust?

Family trusts are more commonly known for your snotty nosed kids you see on the movies. but here in Australia, trusts hold a significant place and can assist in building your wealth. There are many types of trusts and which one you should choose depends on many factors such as the type of investment, whether […]

10 tips to help rental property owners save time and money

The following ten tips will help rental property owners avoid common mistakes. Getting these things right will reduce the risk of failing an ATO audit and save you time and money. 1. Keeping the right records You must have evidence of your income and expenses so you can claim everything you are entitled to. Capital […]

Plan Not To Fail – But Protect Your Assets Just in Case

Business owners are, by nature, optimists. To open and run a small business you have to believe in your industry, your ideas, your team and yourself. Working with potential business owners to buy or set up a new business is an exciting time for all concerned. Everything is bright, shiny and new – and […]

Digital Confusion on GST

Goods and Services Tax (GST) was introduced more than 17 years ago. Most people understand the basics, but there are still some areas that prove tricky to understand. Imported Services and Digital Products From 1 July 2017, Australian GST applies to imported services and digital products. Some common examples of imported services and digital […]

Attempt to Clarify New Small Business Tax Rules

In the wake of the confusion surrounding which companies may qualify for the new lower company tax rates, the government (via Treasury) has released draft legislation on how the rules may apply. The draft legislation outlines that companies will only qualify for the new lower 27.5% tax rate if: The company carries on […]

Be Uber careful with car expenses

Tax issues associated with ride sourcing services such as Uber remain a hot topic of debate. How to claim car expenses related to these activities is one frequently asked question. In simple terms, the rules for ride sourcing vehicles are no different than that for any other taxpayer. Car claims need to be made using […]