5 Most Common Tax Mistakes, Straight From The ATO

Are you ready for a call from the ATO? Contact will be made with taxpayers either directly or via their registered tax agent in the coming months. With tax time 2018 already having begun, the ATO has published the five most common tax mistakes identified in recent audits and reviews. ATO data revealed the top […]

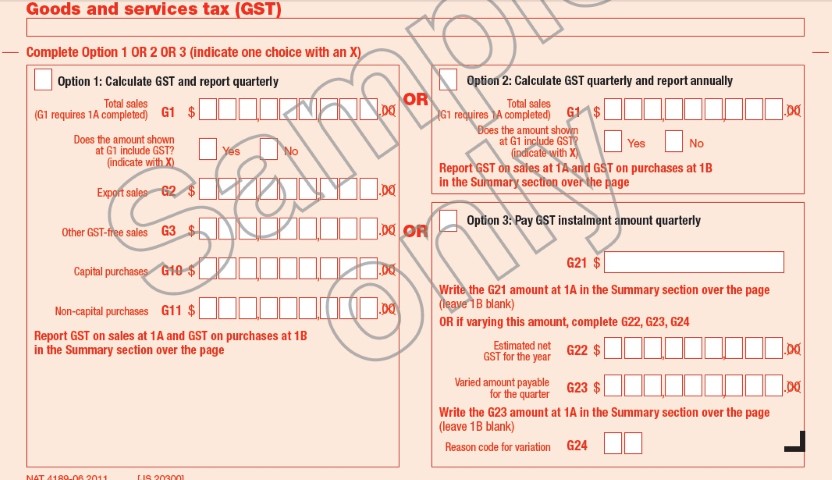

Suffering a Bad Case of EOFY BAS?

The end of financial year (EOFY) business activity statement (BAS) is an important document due at a very busy time. It looms as businesses finalise their results for the year, collect debtors, pay creditors, round off the year’s payroll, search for extra deductions and plan the year ahead. All this needs to be incorporated in […]

Cashflow Control – Making Sure You Don’t Run Out of Money

Cashflow is king when it comes to running a small business. In business, you can make any number of profits (or losses) for tax purposes – but you can only run out of money once. As the name suggests, cashflow management is all about managing the movement of dollars in and out of your bank […]

Top Tax Tips For First Time Property Investors

First time property investor? If you’ve taken the plunge this year and are first time property investor, your rental portfolio does mean changes to your tax return this year. The following tips will help you prepare for this year’s all-important meeting with your accountant. Cost Base Details In this first year you should bring all […]

5 Fun Facts About The $20k Instant Tax Write-Off

In May, the Federal Government renewed its commitment to allowing small businesses to receive an instant tax write-off for capital assets costing up to $20,000. The following five facts might help you decide whether you want to take advantage of the asset write-off before 30 June. It’s a great opportunity for small business owners to purchase […]

Tax Planning season now in full swing

All Australian taxpayers are legally allowed to arrange their affairs in a manner which minimises their tax liabilities. The end of the financial year (30 June) end is rapidly approaching, which means now is the time to review your finances and discuss any recommended strategies that could be implemented to provide you with the best […]

Cryptocurrency tax tracking upped with new register

So you think your Cryptocurrency transactions can’t be tracked? New rules now require cryptocurrency exchanges to sign up to a new Digital Currency Register. All transactions exceeding $10,000 will need to be reported to AUSTRAC in line with existing rules for bank transfers and cash transactions. Taxpayers will need to show where the money came […]

ATO Alert – ATO data matching – motor vehicles

The ATO will acquire information for the 2016-17, 2017-18 and 2018-19 financial years on vehicles that have been transferred or newly registered where the purchase price or market value is equal to or greater than $10,000. Data will be acquired from the eight state and territory motor vehicle registry authorities. It is estimated that […]

Business Payroll Reporting: Beware Being Fooled by New Single Touch System

April 1, 2018, was the key date to analyse whether your business needs to comply with the new single touch business payroll reporting (STP) requirements. Single Touch Payroll is a reporting change for employers with 20 or more employees which began from 1 July 2018. It involves reporting to the ATO salaries and wages, pay […]

Procrastinating About Overdue Tax Returns?

Let Us Help Get You Up To Date When you have been involved in a business that completes thousands of tax returns each year, for more than 25 years, you’ve heard just about every excuse why people delay or avoid lodging their returns. Regardless of the excuse you fall back on, the obligation to lodge […]