Top 10 Tax Deductions For Medical Professionals

Medical graduates are educated and trained to deal with many complex situations, but that doesn’t include preparing your tax returns as a working professional. Under the Australian tax system, the more you earn, the more you are taxed. For this reason, it is important to be aware of the legal deductions that can increase your […]

Why Does Deb Ask So Many Questions?

It is great to welcome new tax clients to our practice each year. Many of these new people have been recommended by existing clients or have Googled us and been impressed by the number of positive reviews and ratings. During appointments with these new clients, many comment that we do ask a lot of questions […]

Tradie Tax Confusion

Five Strategies To Help Avoid The Year Two Business Cashflow Blues Moving from earning wages to owning a business can be a confusing time for tradespeople, especially when it comes to tax. You may know a lot about plumbing, electrical wiring or carpentry, but understanding how the business tax system works can be one of […]

Salary Sacrifice for Medical Professionals

Working as a medical professional in a private or public hospital allows you to access a tax free salary sacrifice benefit. This equates to a tax free amount of around $9,000 per year coming straight off your gross income that can be spent on non deductible private expenses such as rent, a home mortgage, gym […]

Beware of Tax Time Scams

Taxpayers need to watch out for fraudsters who use tax time as an opportunity to extort money and personal information from unsuspecting victims. The ATO has warned that tax scams spike at this time of year. Last year the ATO received more than 81,000 scams reports, with more than $2.4 million being paid to scammers and almost 10,000 people providing their personal information. Just under […]

Does The Tax Office Owe You Pots of Money?

A very nervous couple came to our office recently and confessed to having 12 years (each) of overdue tax returns. With our help, they are now up to date, extremely relieved and $85,000 richer. People who get behind with their tax returns can sometimes put their heads in the sand. The task begins to look […]

5 Most Common Tax Mistakes, Straight From The ATO

Are you ready for a call from the ATO? Contact will be made with taxpayers either directly or via their registered tax agent in the coming months. With tax time 2018 already having begun, the ATO has published the five most common tax mistakes identified in recent audits and reviews. ATO data revealed the top […]

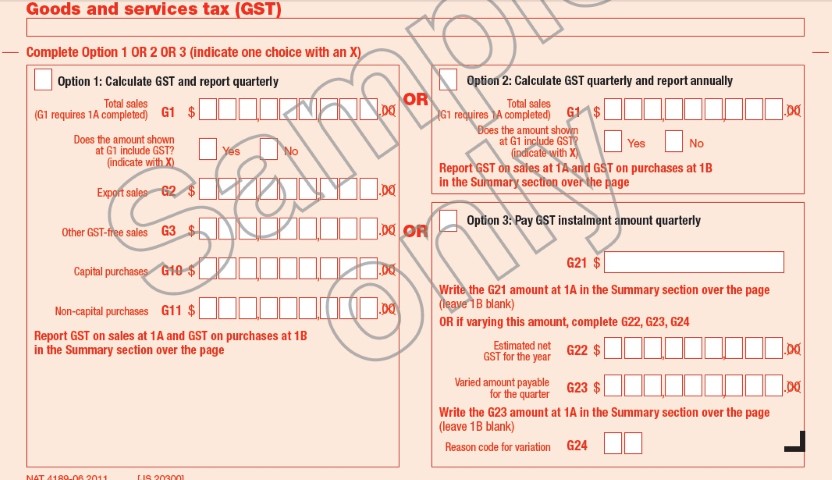

Suffering a Bad Case of EOFY BAS?

The end of financial year (EOFY) business activity statement (BAS) is an important document due at a very busy time. It looms as businesses finalise their results for the year, collect debtors, pay creditors, round off the year’s payroll, search for extra deductions and plan the year ahead. All this needs to be incorporated in […]

Cashflow Control – Making Sure You Don’t Run Out of Money

Cashflow is king when it comes to running a small business. In business, you can make any number of profits (or losses) for tax purposes – but you can only run out of money once. As the name suggests, cashflow management is all about managing the movement of dollars in and out of your bank […]

Top Tax Tips For First Time Property Investors

First time property investor? If you’ve taken the plunge this year and are first time property investor, your rental portfolio does mean changes to your tax return this year. The following tips will help you prepare for this year’s all-important meeting with your accountant. Cost Base Details In this first year you should bring all […]